Financial Empowerment Conference

The LORD will open the heavens, the storehouse of his bounty, to send rain on your land in season and to bless all the work of your hands. You will lend to many nations but will borrow from none the seed sprouts and grows, though he does not know how.

Deuteronomy 28:12

CLICK HERE TO REGISTER NOW

During this year the Financial Empowerment Conference Series celebrates 15 years of empowering people to live an abundant life, and we have many activities planned for before, during, and after the conference. Please use the links below to jump to the area(s) you are most interested in finding out more about.

The Financial Empowerment Conference

Post-Conference Activities & Programs

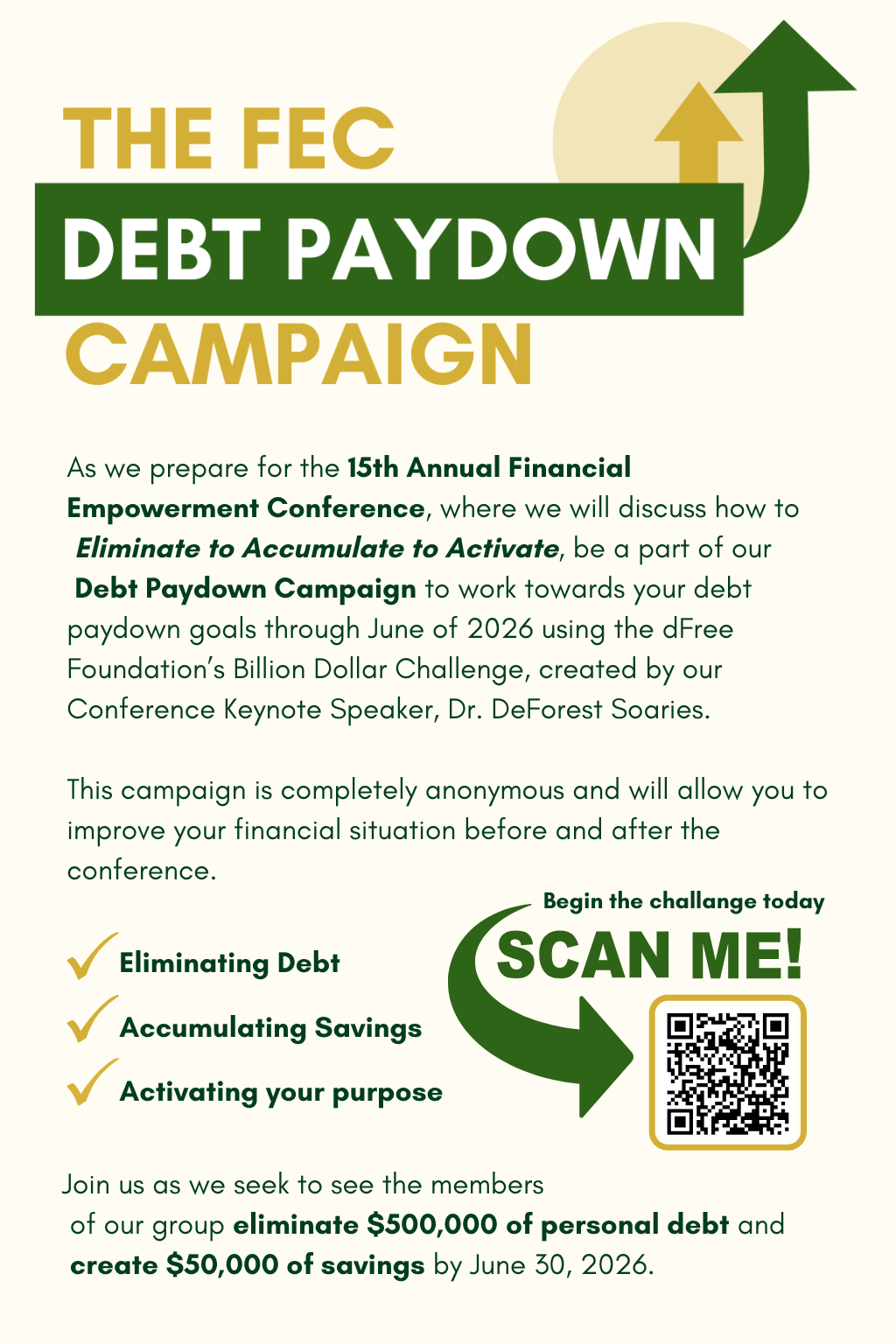

The Debt Paydown Campaign (Eliminating $500,000 of Debt and Creating $50,000 of Savings)

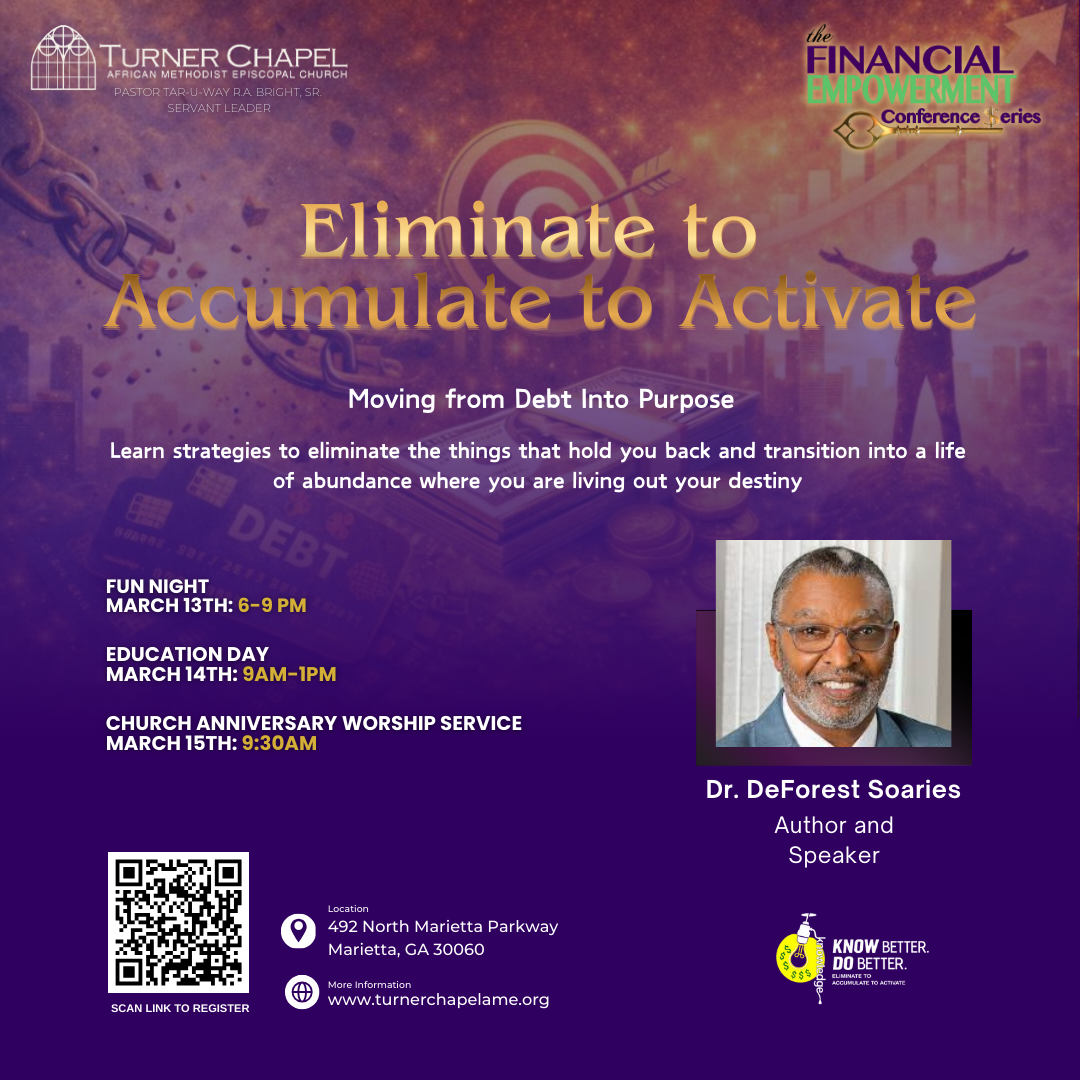

THE FINANCIAL EMPOWERMENT CONFERENCE

ABOUT THE CONFERENCE

The motto of the Financial Empowerment Conference Series is KNOW Better. DO Better., because we believe it's not only important to know what to do but to take the necessary action to put what you know into practice and improve your financial situation. As we embark on the 15th edition of the series our theme is Eliminate to Accumulate to Activate: Moving from Debt Into Purpose. This theme speaks to the importance of getting rid of things that hold you back, debt or otherwise, so you can prosper and live out your destiny. We are encouraging everyone to accept the personal challenge of eliminating their debt load, just as Turner Chapel is in its Next Level Giving Campaign to retire the mortgage on the Cathedral, which is why we are including this year's Church Anniversary as part of Conference Weekend as we celebrate the conclusion of Phase 2 of the Next Level Giving Campaign. Our programs in 2026 will provide you with information, tools, and strategies to free yourself from debt and use that freedom to create a better financial future. The 15th Annual Financial Empowerment Conference Series begins with our popular and entertaining Friday Fun Night, where you can enjoy food, games, and fellowship, a power packed day of learning on Saturday, and inspiration during our Sunday Morning Worship service. Join us for this weekend of inspiration, education, and fun.

EVENTS SCHEDULE

FRIDAY FUN NIGHT ACTIVITIES

March 13

6:00 - 7:00 PM Food & Time to Visit with Sponsors

7:00 - 9:00 PM Game Time

Financial Fun Night opens our conference weekend with an evening of food, fun, and games. Contrary to popular opinion, finances can be fun, and our Host, Chesley McNeil, will serve as the emcee for our game show, Financial Family Feud, which will have teams of participants competing for the Rev. Phyllis T. Ailes Fun Night Championship award. Attendees can also win prizes by participating in our audience games.

SATURDAY EDUCATION DAY ACTIVITIES

March 14

9:00 - 9:30 AM Continental Breakfast & Networking

9:30 - 9:40 AM Opening Activities

9:40 - 10:25 AM Keynote Address by Dr. DeForest Soaries

10:25 - 10:45 AM Sponsors Spotlight and Conference Series Preview

10:45 - 11:45 AM Panel Discussion with Q&A

11:45 - 11:55 AM Closing Activities

12:00 - 1:00 PM Overtime Session - Visit with Our Speakers and Sponsors

TURNER CHAPEL'S 161st CHURCH ANNIVERSARY

March 15

9:30 AM Worship Service

Dr. DeForest Soaries, Guest Preacher

FEATURED SPEAKERS

Keynote Speaker

For this milestone anniversary of the conference, we will have a Keynote Address. Our Keynote Speaker is Dr. DeForest B. Soaries, who served as our featured speaker for the 3rd edition of the conference in 2014. He is well known for his participation in CNN's 2010 documentary, Almighty Debt, part of their Black in America series. He started the dFree(R) Foundation in 2005 to promote financial self-sufficiency and has been an advocate for both personal and community financial empowerment for decades.

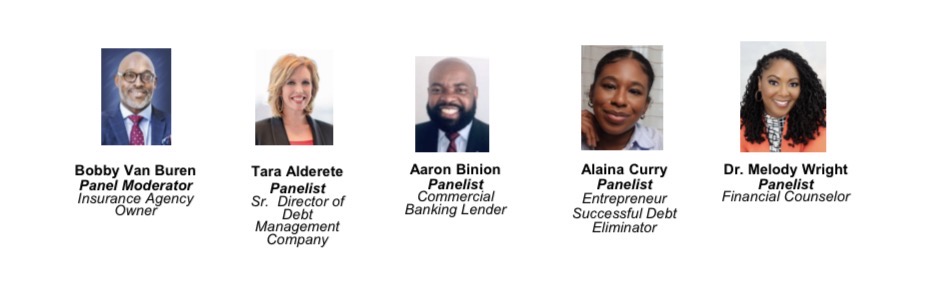

Financial Panel Discussion

This year's conference panel is a combination of professionals with expertise in personal finance and someone who has lived out the theme of Eliminate to Accumulate to Activate by executing a plan to pay off ten's of thousands of dollars in debt. We have professionals from the debt management and commercial lending spaces as well as a financial counselor who coaches clients through all aspects of their financial lives. The panel will share insights on how you can overcome obstacles to your financial freedom and answer questions to help you get on the path to living out your purpose. Register today so you can participate in this very important conversation.

How to Join the FEC Group

- Create an account using the Sign Up link on the dFree Foundation’s Billion Dollar Challenge website by going to the link https://bdc.dfreefoundation.org in your Google Chrome browser

- After logging in, select the Groups link to join a group, and use the search bar to find the group Turner Chapel AME Financial Empowerment Conference, and select the group.

- After selecting the group, we will receive a notification of your request to join, and then wait for confirmation that your request has been approved.

Entering Your Goal(s)

- Return to your Dashboard by clicking the Dashboard link.

- To enter a Debt Paydown goal, while on the Debts page of your Dashboard, click on the gold + sign to add a Debt goal.

-Enter a name for each Debt Goal, the type of debt you are seeking to pay down, the interest rate (if the rate is 0%, enter a minimal number like 0.1%), the type of interest for the debt, the starting date and end date (we suggest a date in June 2026), the amount you intend to pay on the debt during the period, and the frequency of payment.

-The system will calculate the required amount of each payment.

-Click Create to complete the goal data entry.

- Upon completion, you will see a summary of the Debt goal on your Dashboard.

- To enter a Savings goal, click the link to go to the Savings page of your Dashboard, click on the green + sign to add a Savings goal.

-Enter a name for each Savings Goal, the type of and purpose of the goal, the

-Start Date and Target Date (we suggest a date in June 2026), the amount you intend to save during the period, and the planned frequency of each savings deposit.

-The system will calculate the required amount of each savings deposit.

-Click Create to complete the goal data entry. - Upon completion, you will see a summary of the Savings goal on your Dashboard.

Entering Your Payments/Deposits

- Select the Debt or Savings Goal to which you will apply your payment/deposit.

- Click the middle icon to the right of the goal description to log a payment/deposit.

- Enter the payment/deposit amount and click the Update button.

- Upon completion, you the transaction in your Recent Payments history.

Additional Information

- Your participation in this campaign is completely anonymous. We will keep track of the goal amounts of the entire group and the progress made, but only you will know what goals you have entered and payments you have made.

- You can withdraw their request to join the group or can leave the group at any time.